It is an close of an era.

Which is BlackRocks Inc.’s

BLK,

Tony DeSpirito, chief financial investment officer in the U.S. elementary equities division of the world’s premier asset supervisor, telling investors to prepare for the conclusion of a backdrop of small-premiums and gradual-progress which is described markets because the 2008 global financial crisis.

Regardless of a precarious start out to 2022, “one point we come to feel rather particular about is that we are exiting the investing regime that experienced reigned considering the fact that the International Money Disaster (GFC) of 2008,” DeSpirito wrote in a next-quarter outlook Monday.

The equities team sees not only a “new environment order” getting shape that will “undoubtedly entail bigger inflation and prices than we realized from 2008 to 2020,” but a trickier setting for traders, specially as Russia’s war in Ukraine threatens to retain vitality

CL00,

and commodity costs in emphasis.

“Perversely, the circumstance could favor U.S. stocks, as they are additional insulated than their European counterparts from electricity rate spikes and the direct impacts of the war and its economic ramifications,” DeSpirito wrote, adding that a rebalance toward price may possibly be warranted.

“It is also well worth noting that bonds, which commonly get an edge in moments of hazard aversion, are providing less portfolio ballast now as correlations to equities have converged.”

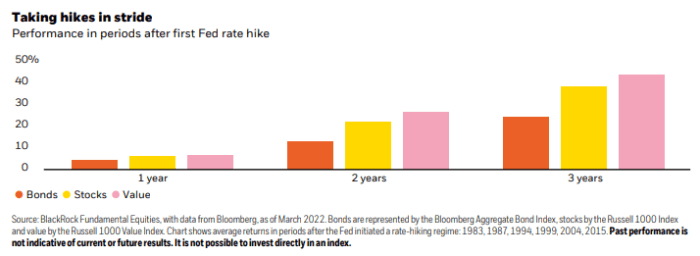

To assistance form its imagining, the crew researched preceding price-hiking cycles by the U.S. central lender, starting off in 1983 to 2015, and observed that worth stocks outperformed their big-capitalization counterparts but also a essential bond-sector benchmark (see chart).

Shares, bonds and in particular worth are inclined to do perfectly 3 yrs after a rate-climbing cycle

BlackRock Essential Equities, Bloomberg

The staff in comparison the efficiency for the Bloomberg U.S. Mixture Bond Index (pink), the Russell 1000 index

RUI,

(yellow) and the Russell 1000 Worth Index

RLV,

(pink). Of note, overall performance was constructive throughout all a few segments, in the initial 3 yrs soon after premiums commenced to maximize.

Other assumptions of the outlook were for inflation to recede from 40-calendar year highs afterwards this year, with the price tag of residing to settle higher than the 2% amount regular just before the pandemic, possibly in a 3% to 4% range, in a worst-scenario scenario.

The group also expects the 10-yr Treasury yield

TMUBMUSD10Y,

to push bigger as the Federal Reserve appears to elevate its key amount, but that it “would have to have to attain 3% to 3.5% in advance of we would issue the hazard/reward for equities.”

The benchmark Treasury price, which neared 2.4% on Monday, is utilized to cost every thing from corporate bonds to commercial assets financial loans. Bigger Treasury prices can translate to harder borrowing ailments for big companies at a time when inflation pressures also can pinch margins.

Continue to, DeSpirito sees likely for an “underappreciated option in companies” with a report of passing larger expenses on to customers, even if they now confront inflation pressures.

“The period of time of exceptionally low fascination fees was extremely good for growth shares —and very challenging for worth investors,” he wrote. “The highway forward is very likely to be distinct, restoring some of the enchantment of a benefit system.”

Stocks rallied on Monday, led by the technology-large Nasdaq Composite Index

COMP,

as it recorded its greatest day in extra than a 7 days, with the S&P 500 index

SPX,

and Dow Jones Industrial Ordinary

DJIA,

also scheduling gains.

See: Stocks are rallying because of what an inverted produce curve says about the Fed and inflation, strategist says