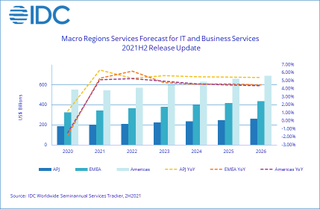

NEEDHAM, Mass.—Despite uncertainty about inflation, global offer chain challenges, Covid 19 and the war in Ukraine, the International Information Company (IDC) has produced new forecasts displaying that around the world IT and small business providers income is expected to develop by 5.6% (in continual currency) in 2022.

IDC’s Throughout the world Semiannual Expert services Tracker stories that the 2022 market place growth represents an boost of 160 basis details (or 1.6%) from IDC’s October 2021 forecast.

The improved market view reflects strong 2021 bookings and pipelines by many big expert services providers, an improved financial outlook (in contrast to the former forecast cycle), and inflationary impression on the products and services current market, offset a little bit by the damaging effect of the Ukraine/Russia conflict, the researchers stated.

IDC also is predicting that the industry will keep on to grow during the following couple of a long time at a price of 4-5%, symbolizing an total boost of 40 to 80 basis points just about every 12 months, pushing the market’s extended-expression growth rate to 4.6%, up a little from the former forecast of 4.3%.

“In this forecast cycle, IDC companies analysts have looked at brief-expression impacts, these as pent-up desire and the Ukraine/Russia conflict, as well as more structural ones, this sort of as adoption of public cloud, the talent crunch, inflation, info stability/residency/sovereignty, and far more,” explained Xiao-Fei Zhang, system director, IDC Worldwide Products and services Tracker method. “Centered on our analysis, we altered our outlook appropriately at the marketplace stage.”

“Nevertheless, at the personal vendor degree, expert services suppliers will need to brace for far more volatility,” Zhang continued. “On the heels of a world pandemic, enterprise prospective buyers facial area one more black swan function in 2022, which will accelerate significant world-wide developments, this sort of as remaking the world offer chain and price chain and exacerbating the expertise crunch by switching demographics. We need to hope extra of ‘the unexpected’ in the many years to occur. In the course of the past two a long time, the providers vendors who succeeded were being the kinds who have verified to be resilient associates assisting their clientele prosper in transform. This has generally been the frequent power to push development in the companies marketplace.”

Inside the IT and business solutions markets and throughout all areas, cloud-linked companies expending has been the principal advancement accelerator considering that 2020, the scientists claimed. IDC forecasts it to go on to increase close to 20% year above yr in 2022 and amongst 15% to 20% around the subsequent 3 decades.

The Americas companies market place is forecast to develop by 5.3% in 2022, up 150 basis details from the Oct 2021 forecast (in consistent currency.)

The IDC attributes this to a quicker economic rebound and the influence of inflation. IDC believes that the craze will continue on in the small-time period: 2022 and 2023 growth rates have been modified up by 150 and 100 foundation points, or close to 4% 12 months-around-calendar year progress for the up coming 5 years.

The outlook for the U.S. current market has also been also adjusted up by 160 and 80 basis points for 2022 and 2023, respectively, the IDC reported but the extended-time period U.S. expansion prospect remains mainly unchanged.

The IDC’s mid- to long-phrase progress potential customers for Canada and Latin America enhanced marginally. Each locations will continue on to see restoration effectively into 2022 and 2023. Latin America’s in the vicinity of-phrase expansion outlook is even more lifted by the commodity cost rally considering the fact that March.

The 2022 advancement forecast for EMEA (Europe, Middle East, and Africa) was raised by a lot more than 220 basis details.

IDC has lessened the Central & Japanese Europe (CEE) forecast drastically because of to the conflict in the Ukraine. It expects the CEE companies industry to mature only by 5.5% and 7.3% in 2022 and 2023, respectively, down from our earlier forecast of 9-10% progress. Russian and Ukraine markets will shrink considerably this 12 months.

But, Western Europe’s in close proximity to-phrase development forecast has been adjusted up: IDC now forecasts the area to improve by much more than 6% in 2022, up by 280 basis details from our previous forecast. The improved outlook is largely thanks to the EU’s revised 2022 GDP outlook at the end of the conclusion of 2021 (prior to the Ukraine/Russian crisis). IDC proceeds to see EU-funded investments driving solutions expending. Inflation also contributed to nominal expansion, whilst to a smaller sized diploma.

This was partially offset by the Ukraine/Russia conflict. IDC thinks that the crisis will dampen Western Europe’s mid-phrase current market development but will be offset by other motorists.

The Middle East & Africa’s (MEA) progress prospective clients for 2022 and 2023 have also been elevated by 250 and 100 foundation factors, respectively.

Asia/Pacific’s expansion outlook improved by .9 proportion details in 2022, mainly due to PRC (China) and other designed Asian marketplaces (i.e., Australia, Japan, Singapore, Korea, etc.).

The forecast for China’s industry advancement has been adjusted up to 6.4% and 8% for 2022 and 2023. Even though China’s GDP advancement is predicted to awesome down, IDC believes that electronic transformation continues to be central to the country’s long-term “new infrastructure” initiatives, which will more generate products and services shelling out in both of those the community sector and strategic industries these types of as BFSI, manufacturing, and electrical power.