Table of Contents

Paying out Costs

For those who conserve for retirement, the greatest asset allocation is that which supplies the best returns, with an appropriate stage of possibility. However, chance-adjusted returns never right handle the demands of people who are retired, because they have a tendency to consume alternatively than accumulate. What issues most for those people who have ceased performing is not portfolio progress, but in its place paying out energy.

As a result, the quality of a retiree’s allocation is typically evaluated by the withdrawal level that it permits. What share of belongings can the retiree safely and securely devote? The remedy to that problem incorporates various relocating areas, together with: 1) the retiree’s lifestyle span, 2) the variability of shelling out, and 3) the rate of investment return. Commonly, the dilemma is simplified by fixing the very first two inputs. The lifetime span is established at 30 a long time, and the paying out system is static, with just about every year’s withdrawal matching the earlier year’s amount, after modifying for inflation.

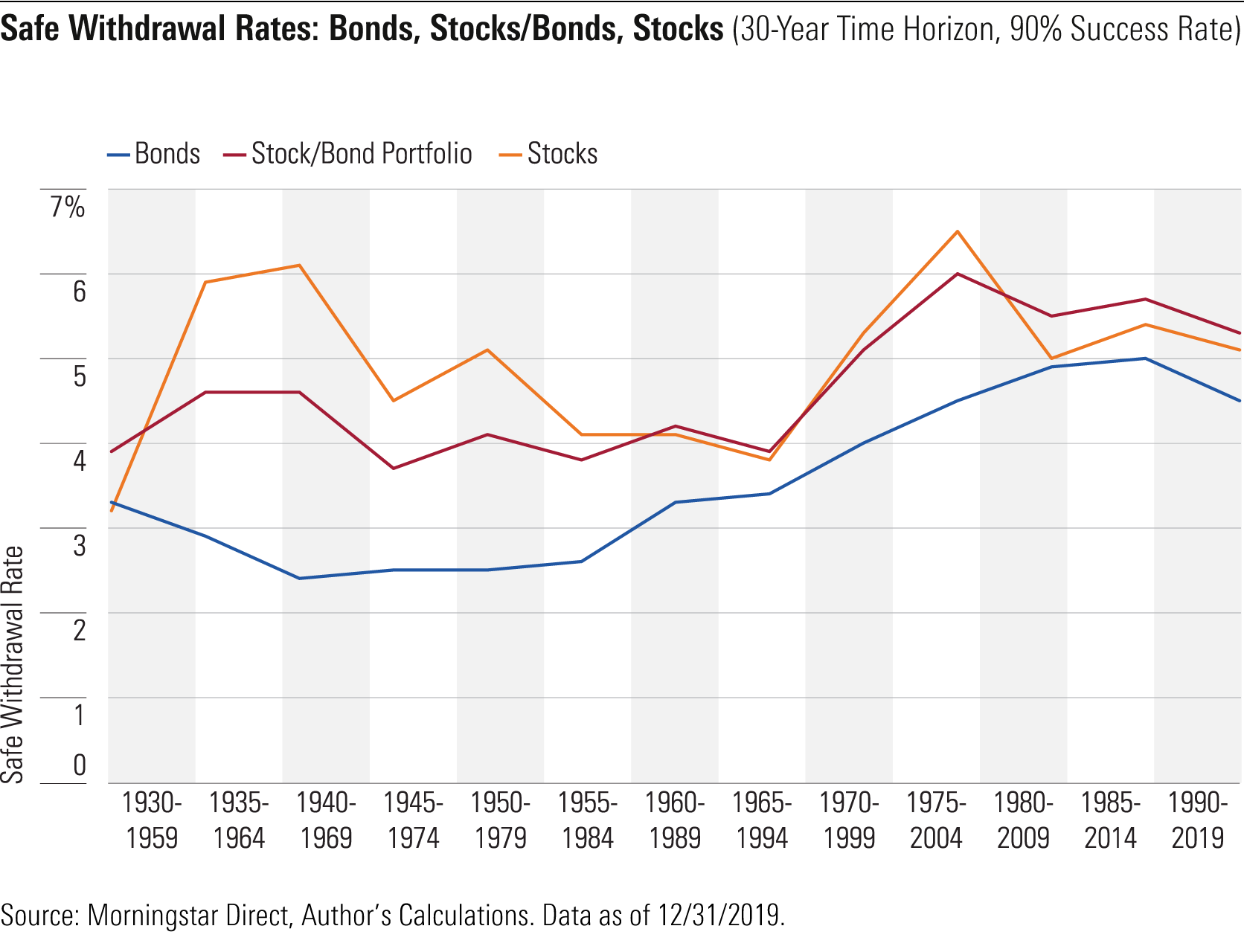

The following chart depicts secure withdrawal charges for U.S. buyers about the earlier 80 several years, for three asset allocations: 1) an intense portfolio consisting of 100% stocks, 2) a moderate portfolio that holds 50% stocks, 40% bonds, and 10% dollars and 3) a conservative portfolio that has 90% bonds and 10% hard cash. The figures are derived by simulating 1,000 potential current market performances, using the typical returns and standard deviations that shares, bonds, and funds recorded in the course of those eras, alongside with the amount of inflation. The safe and sound withdrawal price is defined as the best quantity that can be eradicated for all 30 many years of the simulations with no depleting the portfolio in at the very least 90% of the simulations.

(Take note: My estimates are relatively decreased than individuals computed by Bill Bengen in his seminal 1994 paper, “Figuring out Withdrawal Fees Employing Historic Data.” The discrepancy occurs mainly because Bengen evaluated the solitary result of background, while I regarded additional alternatives.)

Supplementing Bonds

Help you save for the first interval of 1930 via 1959, the seemingly rash approach of investing of completely in equities regularly surpassed keeping only bonds. Happier but was the center road. Not when did the safe withdrawal price for the bond allocation land inside half a proportion position of the reasonable portfolio. No issue what the crisis–the Great Despair, the stagflation of the ’70s, or the new millennium’s technological innovation-inventory crash–possessing a meaningful stake in shares served retirees with a 30-calendar year time horizon, relatively than hurting them.

All round, the performances of the aggressive and moderate portfolios have been around comparable, as measured by safe and sound withdrawal fees. The intense allocation led the way by way of most of the early many years, as equities recovered from their Great Despair lows. Results have been blended above the following quarter century. Most a short while ago, the inventory/bond mix has moved ahead. The vital final decision has not been how lots of equities to keep, but somewhat to very own them at all.

An additional Perspective

Though cash appreciation is not the primary aim for most retirees, conserve for people who are so rich (or who possess this kind of modest needs) that they have to have not be concerned about overspending, it nevertheless is a helpful thing to consider. Additional assets usually means better economic flexibility. Retirees can use their further monies to give themselves raises, pay out sudden costs, or donate to charities. They could also select to depart much larger bequests.

For this secondary purpose of funds development, equities are paramount. The subsequent chart illustrates the point. It portrays the median ultimate values for the financial commitment pools–that is, the median amount of assets that continue being at the end of the rolling 30-year durations, immediately after the essential withdrawals have been funded. For comparison’s sake, every single calculation assumes a $1 million first financial investment and the identical 4.% withdrawal rate. (If the ultimate values seem to be really high, that is due to the fact these amounts are calculated in nominal terms, and as a result involve 30 years’ value of inflation. Even with out the influence of inflation, while, the last values for the stock portfolios are usually previously mentioned the starting off volume, when expressed in actual conditions.)

Stocks, shares, and much more shares! By this evaluate, the competition in between the intense and reasonable portfolios is no contest. Across all durations, the 100% fairness allocation steamrolls any method that includes bonds. That even happened from 1930 nevertheless 1959, when the safe withdrawal rate for the all-equity portfolio was almost a whole proportion point beneath that of the inventory/bond allocation.

The Comprehensive Distribution

Equities look substantially much better mainly because the second chart exhibits median values, relatively than the comparatively bad consequence of the 90th percentile that was used for the withdrawal price chart. Back in the day, retiree plans implicitly assumed median outcomes, but subsequent criticism from Nobel laureate William Sharpe, amongst many others, practices adjusted. These days, most retirement-preparing plans focus on a substantial achievements price. My program was no exception.

When there’s much to be mentioned for the new custom–handful of retirees would willingly concur to ideas that have been predicted to fall short half the time!–it does comprise a major drawback. By basing the investment determination completely on preventing lousy success, the conservative approach ignores other results. Dodging expenditure catastrophe is a wonderful purpose. But it should not represent the full examination.

In addition to highlighting a earlier hidden benefit of the 100% fairness portfolio, the 2nd chart even further demonstrates the hazard of relying entirely on bonds. Not only have set-revenue allocations frequently struggled to generate prosperity, but throughout some 30-year periods, even their median outcome has not been ample to fund a 4% withdrawal level. For retirees in search of to shell out an adequate quantity while maintaining rate with inflation, bonds have been distinctly unsafe.

Hunting Ahead

History’s lesson is straightforward: the much more stocks, the merrier. Investing solely in equities constantly produced both the highest secure paying rate for a given 30-12 months time period, or a rate that wasn’t significantly off the mark. What is far more, all-equity portfolios had been significantly likelier to deliver a pleased surprise than to disappoint.

Need to the foreseeable future resemble the previous, the lesson will remain legitimate. Retirees ought to invest intensely in equities, most probably much more than they currently do. But the suggestions rests on that original assumption. Subsequent Tuesday’s column will seem ahead alternatively than backward, by discovering how the upcoming time may well be various.

John Rekenthaler ([email protected]) has been studying the fund marketplace considering that 1988. He is now a columnist for Morningstar.com and a member of Morningstar’s financial investment research section. John is quick to level out that whilst Morningstar generally agrees with the views of the Rekenthaler Report, his views are his have.