Table of Contents

A former edition of this column gave the incorrect date for the Fed coverage choice. The tale has been corrected.

Investors searching at their screens this early morning might really feel a bit of reduction, with oil selling prices easing off and inventory futures pointing to a rally. Which is tied to refreshing hopes talks between Russia and Ukraine will basically get somewhere this week, as the humanitarian disaster only worsens.

These challenging occasions make it all the far more worthwhile to hear to what marketplace veterans have to say. Our contact of the working day is from Charlie Dreifus, portfolio manager at Royce Financial investment Partners, who provides bear-current market tips from his 54 decades of working experience (many thanks to Hedge Fund Strategies).

In a modern interview posted on Royce’s web page, he recalled doing the job as a youthful pension fund supervisor in 1972-75. “And this was at a time when, significantly like the FANG stocks of these days, there was an anointed group that marketed at very large valuations,” said Dreifus.

He was referring to the Nifty Fifty, a team of substantial expansion stocks — McDonald’s

MCD,

Coca-Cola

KO,

Disney

DIS,

Walmart

WMT,

and so on. — that surged from the 1960s right until the 1973 bear market place, a 50% fall from best to bottom, explained Dreifus, who shares what a veteran trader advised him at the time.

“And he states to me, ‘Charlie, hold your horses. This is the commencing of a bear sector. What you’ve got to do is rate your purchases, dollar expense ordinary. You really don’t know how extensive this is going to choose.’”

That led to him mastering about the worth of pyramids in investing. “What you do is you obtain, assume of the major of the pyramid, you acquire a very little. And as the value declines, you purchase far more. And on days that market place goes up, you stop shopping for, on the presumption it’s going to down tomorrow or the day just after,” he reported.

The Particular Fairness fund

RYSEX

that he manages for Royce is a small-cap value fund looking for out “conservatively managed businesses with clear accounting that have a practical specialized niche or franchise whose stock can be purchased down below its financial value.”

He also available up three inventory ideas, as he admitted they weren’t effortless to obtain, with valuations continue to substantial even immediately after the new industry pullback.

First up is tax preparer H&R Block

HRB,

which he likes for its “strong financials, quite major income flow” and dividend yield. Whilst some stress about consumers drifting absent as COVID-19 rewards dissipate, he thinks many will adhere around for the “suite of monetary services” H&R delivers that they do not usually get.

Dreifus also likes nearby Television set provider Tegna

TGNA,

which he notes has experienced numerous suitors circling, with an activist investor also involved. “The stock, in Wall Avenue phrases, is in play in the sense that persons anticipate a offer above its recent price tag and of course the recent price is previously mentioned the cost we paid for it,” he reported, incorporating that he likes Tegna deal or no deal.

Huntsman

HUN

is his last decide on. The corporation that remodeled from a commodity chemical substances enterprise to a specialty chemical compounds group has also “deleveraged to a extraordinary degree,” attracting an activist in the system.

“We will not acquire a inventory mainly because it’s in perform or there’s activist talks. It should be a fantastic investment first. But we’re acquiring, as I explained, raising occasions of this,” reported Dreifus.

The buzz

Talks among Russia and Ukraine resumed on Monday, as violence continued and dozens ended up killed from a fatal attack on a armed forces schooling centre around the Polish border. And Washington and Beijing stability officials will satisfy in Rome, with allegations that Russia questioned China for military services enable high on the agenda.

Russian prosecutors have warned executives at Western enterprises these kinds of as McDonald’s

MCD

and IBM

IBM

over any governing administration criticism.

Spreading COVID-19 scenarios have forced a lockdown of the Chinese tech hub Shenzhen, closing manufacturing at Apple

AAPL

supplier Foxconn

TW:2317.

Apple and Nvidia shares

NVDA

are the two down in premarket.

And Pfizer’s

PFE

CEO said a fourth COVID-19 shot will be required, though photographs for young small children could start off in May possibly.

Economic highlights this 7 days include things like retail profits and a Federal Reserve choice on Wednesday, with the to start with interest-level improve anticipated since late 2018. The Lender of England and Bank of Japan will also fulfill this 7 days.

Read through: ‘Unprecedented territory’: Investors watch for Fed charge hike amid higher marketplace volatility

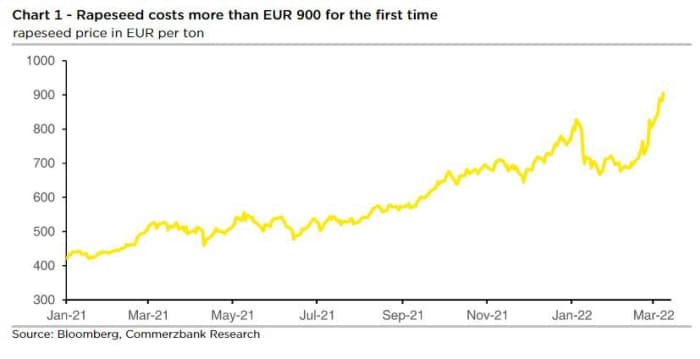

The chart

Insert rapeseed to the listing of commodities whose price ranges are surging subsequent Russia’s brutal invasion of its neighbor.

“The Ukraine war is driving up the rapeseed selling price because 80% of the world’s sunflower oil provides appear from the Black Sea area, so need is now rising for option vegetable oils these types of as rapeseed oil,” notes Commerzbank analyst Carsten Fritsch, who supplies this chart:

“Rapeseed is getting lent further tailwind by the sharp rise in oil prices, as this is also pushing up price ranges of biofuels these as biodiesel, in which rapeseed oil is utilised,” explained the analyst in a be aware.

Canada and China are large producers, along with quite a few European international locations, as perfectly as Ukraine.

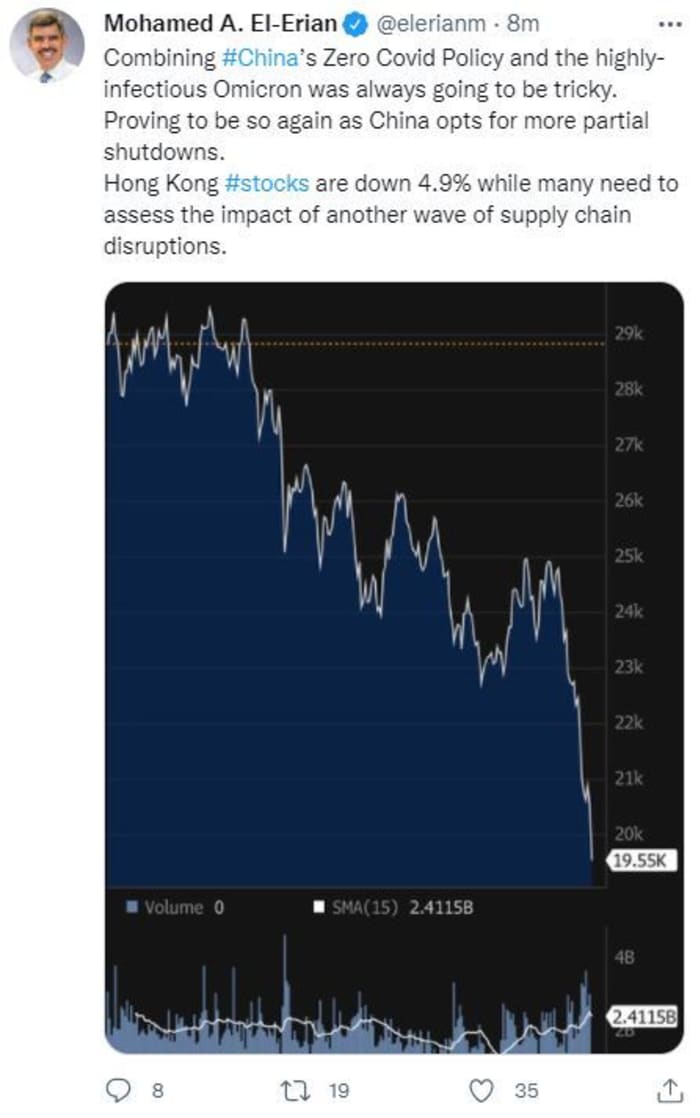

The markets

The Dow and S&P 500 have kicked off Monday’s session with gains, but the Nasdaq

COMP

is down, when bond yields

BX:TMUBMUSD10Y

are on a tear and oil price ranges

CL00

CL

BRN00

are down about 4%. Gold

GC00

is pulling again. European equities

XX:SXXP

bought off to a firmer start out, with Asia primarily lessen, and a 5% fall for Hong Kong shares

HK:HSI

around that COVID-19 lockdown and a ongoing tech selloff.

Prime tickers

These have been the prime-traded tickers on MarketWatch as of 6 a.m. Jap Time:

Random reads

A world IT army of 400,000 worldwide hackers is signing up for Ukraine’s struggle versus the Russian invasion.

The 300-year previous “Wizard of Oz” violin is up for auction.

All those searching ahead to NFL star Tom Brady’s retirement will be bitterly upset.

Require to Know begins early and is updated right up until the opening bell, but sign up here to get it sent after to your email box. The emailed variation will be despatched out at about 7:30 a.m. Japanese.

Want additional for the working day ahead? Signal up for The Barron’s Everyday, a early morning briefing for investors, like exclusive commentary from Barron’s and MarketWatch writers.