Russian stocks and bonds took a further more hit on Monday, when the rouble also sank, as buyers reacted to warnings of a increasing danger of armed forces action against Ukraine.

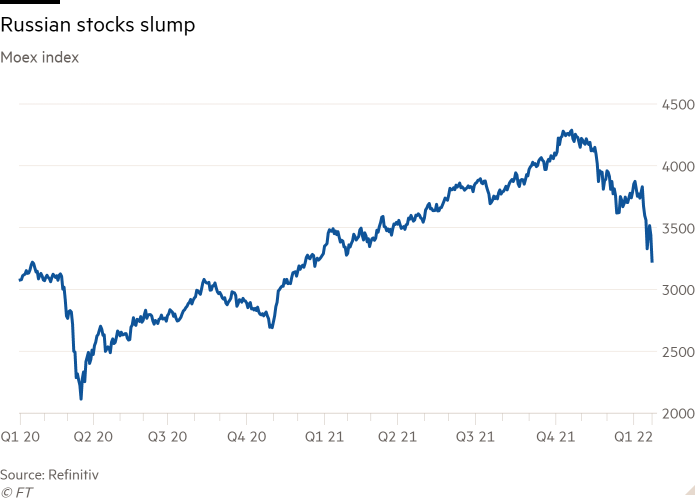

Moscow’s Moex stock index was down a lot more than 5.5 per cent, having its losses so far this yr to nearly 15 per cent, following the partial withdrawals from their embassies in Ukraine by the US and Uk. Russia’s govt debt also slumped, pushing yields to their highest stage in six yrs, as the probable for swingeing western sanctions prompted traders to dump Russian assets.

“All the weekend news is rather lousy,” stated Viktor Szabo, an rising markets fund supervisor at Aberdeen Common Investments. “No one needs to be left keeping lengthy positions in Russia, so every thing is advertising off these days.”

The rouble lost extra than 2 for every cent from the greenback to strike its weakest stage considering the fact that November 2020. The slide prompted the Russian central financial institution to halt its common international-trade purchases in a transfer it stated aimed to “reduce the volatility of money markets”. The rouble trimmed its losses after the announcement to trade 1.7 for each cent reduce, down extra than 10 for each cent considering the fact that Oct. The generate on Russia’s 10-calendar year local currency authorities financial debt climbed to 9.75 for every cent, up from 7.5 for every cent a few months in the past and the maximum due to the fact early 2016.

The most recent provide-off came as the United kingdom purchased some of its embassy staff to leave Ukraine, just after the US purchased loved ones customers of its embassy employees to leave Kyiv because of the possibility that Russia would consider “significant military services action”. Nato has also stated its users are putting armed forces forces on standby and “sending supplemental ships and fighter jets” to allied nations around the world in eastern Europe.

Russian belongings have arrive less than growing tension in the course of weeks of mounting pressure on Ukraine’s jap border, where Russia has amassed about 100,000 troops whilst building sweeping stability demands of the US and Nato. The rising danger of conflict has jolted western buyers who loaded up on Russian property previous calendar year, drawn by the country’s high curiosity fees and conservative administration of its economy when compared with several other emerging markets.

Russian bonds and its forex are now very low cost, but investors are planning for the risk that tighter western sanctions — these types of as a prohibition on trading Russian bonds in the secondary market — could depart them stuck keeping rouble assets, in accordance to Szabo. The US and EU have threatened stronger curbs in response to any attack, which could contain moves to slice off Russian banking companies from the global economical process and restrictions on the oil and gasoline exports that supply 50 % of the Kremlin’s budget revenue.

“It has by considerably the ideal economic policy to be located in rising markets,” he said. “But if things go pear-formed it would be a incredibly complicated discussion to have with clientele if you’re trapped onshore.”

Russian personal debt includes more than 7 per cent of a commonly adopted JPMorgan index of rising sector nearby currency bonds, meaning many major traders are in effect compelled to hold the bonds or danger underperforming their benchmark. That would depart a ton of probable compelled sellers of Russia bonds in the party that new sanctions resulted in their ejection from indices.

Supplemental reporting by Henry Foy in Brussels.