2023 is so much giving a platform for turnaround stories. Shopify (NYSE:Shop) appears to be a person these kinds of title benefiting from a modify in sentiment the shares are presently up by 44% 12 months-to-date, with 24% of those people gains shipped in this week’s trading.

Traders had been evidently satisfied with the e-commerce giant’s most current transfer, with the surge coming off the back again of alterations to its regular monthly pricing programs. These have an affect on Fundamental, Shopify, and Highly developed ideas, with all soaring by about 33-34%.

The simple approach will now charge $39, up from $29, the Shopify approach will increase from $79 to $105, and the Innovative approach will expense $399 vs. $299 beforehand.

The firm justified the hikes by noting the pricing plans have hardly changed above the previous 12 many years. New merchants will pay out for the up-to-date strategies straight away, though for present merchants, the new rates will go into influence by late April.

Having into account a “relatively tiny incremental churn,” with a overall just take charge of ~3% compared to 2.9% right before, Baird analyst Colin Sebastian estimates 2023 will yield roughly a $200 million “subscription profits reward.” On an annualized foundation, Sebastian anticipates incremental revenues in the region amongst $300-350 million. The analyst also estimates about 80% of Shopify retailers use monthly options as opposed to yearly preparations.

“Shopify remains a relatively minimal-charge e-commerce system possibility for retailers/manufacturers, and the company has not improved rates in a lot of several years,” noted the 5-star analyst. “Moreover, we really do not assume these price ranges warrant a change for the large majority of retailers, presented the time and exertion required to shift platforms, and our check out that Shopify’s system, in numerous respects, features outstanding e-commerce performance at a sensible value.”

In line with his optimistic approach, Sebastian stays with the bulls. The analyst charges Shop shares an Outperform (i.e., Invest in) (To observe Sebastian’s track document, click on here)

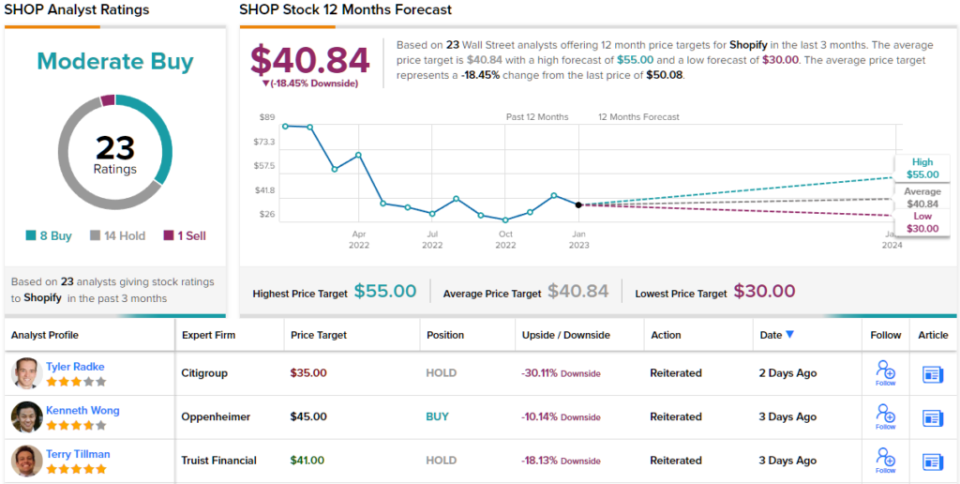

Wanting at the consensus breakdown, based mostly on 8 Buys, 14 Holds and 1 Offer, Wall Street’s analyst corps amount Shop inventory a Average Purchase. Nonetheless, most consider the shares have now surpassed their truthful value the ordinary goal stands at $40.84, suggesting the inventory will be transforming hands for an 18% discounted in a year’s time. (See Shopify stock forecast)

To come across good ideas for stocks investing at interesting valuations, stop by TipRanks’ Best Shares to Get, a newly introduced instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed in this short article are entirely those people of the highlighted analyst. The content is supposed to be made use of for informational functions only. It is very critical to do your own evaluation right before building any investment.